classic tax discs old tax discs replica tax discs historic tax discs novelty tax discs aged tax discs British tax discs reproduction tax discs authentic tax discs new (old) classic tax discs

Pre-1948

Duty was calculated at £1.00 per Horse Power (HP) part year from 1921 until 1948. It was calculated at a rate of around 108.3% of one months duty per month.

Up until 1961 you could purchase an annual disc at any time during the year and you would pay a proportional rate of duty.

The full annual rate was shown on the disc itself, but the amount you paid was written on the selvedge which was torn off.

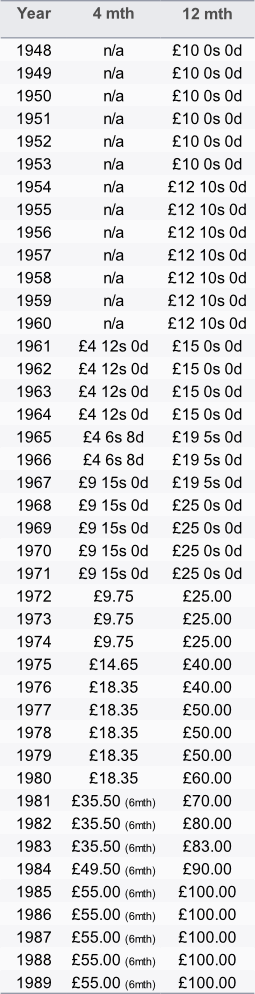

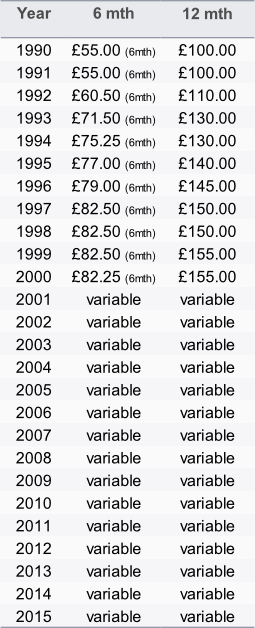

*UK tax rates from 1948 to 2000. (The amount shown on the disc is from the year the tax was paid, not the expiry date)

“For cars registered before 1 March 2001 the excise duty is based on engine size (£140 for vehicles with a capacity of less than 1549cc, £225 for vehicles with larger engines).

For vehicles registered on or after 1 March 2001 charges are based on theoretical CO2 emission rates per kilometre.

The price structure was revised from 1 April 2013 to add an extra charge for the first year (the standard cost was not changed, and remains the same as for 2001 onwards).

The ‘first year rate’ only applies in the year the vehicle was first registered and is said by the government to be designed to send “a stronger signal to the buyer about the environmental implications of their car purchase”.

Still not sure what charge your tax disc should show? Check the chart shown on this Wikipedia link.

Decimalisation arrived in 1972

*IMPORTANT

For some mystical reason tax rates seem to vary within any given year as any Google search will show.

The figures shown here are those we use by default and are here as a guide only.

If it is critical for you to have verified data on your discs please validate the figures from the DVLA direct, or some other trusted source, and let us know when ordering.

We regret that we are unable to carry out extensive data searches on your behalf.

Post 2000

The Government didn’t want to make it too easy!